Historical volatility measures previous value fluctuations over a selected timeframe. Historical volatility solely tells you what volatility was over a previous interval. Implied volatility is derived from possibility prices and represents the market’s expectations for future volatility. It tells you what the volatility is predicted to be over the lifetime of the choice contract. Historical volatility is based on identified actual outcomes; implied volatility is an informed guess about the forex volatility indicator future.

- Understanding forex volatility may help you decide which currencies to trade and how.

- Future-realized volatility eliminates sentiment and offers an goal volatility measure.

- Understanding each past and expected future volatility is key to creating informed investment choices.

- The model was so impactful that it led to a Nobel Prize in Economics for Scholes and Merton in 1997.

Best Volatility Indicators #9 – Historic Volatility (hv)

It serves as a helpful tool for analysts who want to perceive an asset’s previous price fluctuations to doubtlessly anticipate future behaviour. However, it’s important to note that historic volatility does not predict future price actions; it merely quantifies past variations. Market volatility is probably considered one of the most important things to contemplate when buying and selling forex.

Implied Vs Historical Volatility

Historical volatility is a statistical measure of the diploma of worth fluctuation for a safety over a specific time frame. It quantifies the dispersion of returns relative to the typical return, indicating how quickly and unpredictably costs have changed in the past. Volatility research could be extraordinarily useful for short time period trading and intraday derivatives buying and selling. Scalpers and day merchants use volatility to commerce in choices buying and selling as option buyers and possibility writers, both count on volatility to be high for higher returns over time. Volatility analysis works by taking a look at historic value data over a period of time.

In A First, India’s Foreign Exchange Kitty Swells Above $700-billion Mark

It’s notably helpful for setting stop-loss levels and determining place sizes. Unlike scalping, positional trading is extra of a long-term strategy and one of many renowned foreign currency trading strategies. Fundamental analysis plays a crucial position on this technique, and thus minor dip or spike doesn’t affect positional currency traders. Et’s first perceive what these forex markets are all about earlier than leaping to the details about forex strategies.

What Is Volatility In Foreign Exchange Trading?

In essence, it represents what the market “expects” the volatility of an asset to be in the future. This kind is particularly essential in the pricing of options and is a key enter in fashions just like the Black-Scholes. Regime shifts check with transitions between intervals of high and low volatility in financial markets. These shifts in volatility tendencies dramatically impression stock market volatility and are driven by adjustments in investor sentiment, risk perceptions, and market structure. Regime shifts can create alternatives but also result in larger uncertainty and risk. Comparisons between implied and historical volatility reveal when choices are overpriced or underpriced relative to typical actions.

To spot patterns and place profitable trades within the risky Volatility seventy five Index market, use the RSI indicator. To spot robust market movements, use the RSI with period 14 and ranges 50 and 50, then check with the 21 EMA earlier than putting buy transactions. The volatility over a sure time interval is tracked using the Average True Range (ATR) indicator. A greater ATR quantity signifies higher market volatility, whereas a lower ATR signifies decrease market volatility.

However, there aren’t lots of variations between the greatest way the Donchian Channel Indicator is used and the way the opposite channel indicators are used. The bands of the indicator also broaden and contract, depending on the market’s volatility. Bollinger Bands® is a trading indicator, which displays measured volatility by tapering round a financial instrument if volatility is low and widening if it is excessive.

Proper position sizing ensures that no single position jeopardizes the portfolio. Analyzing the correlation between the volatility of various assets helps assemble diversified portfolios. Securities with low or adverse correlations have volatility that moves independently. Combining these property minimizes overall portfolio volatility and concentration danger. Historical volatility, which solely analyzes previous value fluctuations, stands in contrast to each implied and forecasted volatility.

Utilizing choices that expire in 16 and forty four days, respectively, Below are the steps to calculate VIX. The ATR during an uptrend would think about the total range of each candle, together with any gaps between buying and selling periods. As the pattern progresses upward, the ATR would possibly improve, reflecting higher volatility and larger price actions. This is especially noticeable in the longer green candles that point out strong shopping for pressure.

Historical volatility calculates the degree of value variation for a safety over a past interval. This metric quantifies realized volatility primarily based on actual prices, contrasting with implied volatility measures which may be forward-looking. Investors use volatility measures to compare risk throughout securities, modify position sizing, determine trade opportunities, and more.

The volatility enter depends on historic volatility as a proxy for expected future volatility. Higher volatility assumptions improve the chance of the inventory reaching the option’s strike value, thus elevating the fair value value for the option. As the value fluctuations are small, merchants and buyers enjoy sluggish and trendy gains.

One vital turning point within the understanding of volatility got here with the introduction of the Black-Scholes mannequin in 1973. Developed by Fischer Black, Myron Scholes, and Robert Merton, this model revolutionized the pricing of choices and incorporated implied volatility as a key issue. The mannequin was so impactful that it led to a Nobel Prize in Economics for Scholes and Merton in 1997.

Read more about https://www.xcritical.in/ here.

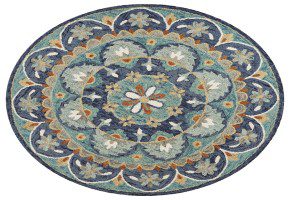

Round Rugs

Round Rugs  Wool Rugs

Wool Rugs  Vintage Rugs

Vintage Rugs

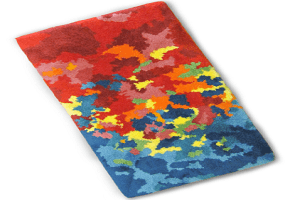

Carpet Tiles

Carpet Tiles  Carpet

Carpet

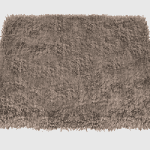

Embossed Rug

Embossed Rug  Plain Rug

Plain Rug

2.5'*4'

2.5'*4'  2'*3'

2'*3'  3'*5'

3'*5'  5*7.5

5*7.5

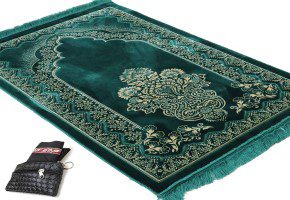

Artificial Grass

Artificial Grass  Mats

Mats

Soil

Soil  Fertilizer

Fertilizer  Pesticides

Pesticides