While many startup founders choose to hire an accountant, it is possible to do accounting yourself or by using accounting services. Technical debt is incurred when you’re working very fast to develop a prototype or working model, and you’re not building everything perfectly. Accounting debt is a similar concept – startups can often ignore creating their accounting infrastructure to focus on their technology or customers. But eventually you’ll need to set up your accounting systems, and the longer you wait, the more you’ll have to go back and fix, just like technical debt.

Venture Capital

- The startup remains in control of fund strategy and investment decisions, but Bain is there to offer advice and lead players in the right direction.

- A compilation is a basic summary of your company’s financial statements.

- Technology makes us more efficient, saving our clients money and letting us offer higher value services like FP&A modeling, 409A valuation, and treasury advice.

- We offer an accounting newsletter with timely tips for growing your business.

- Accounts payable (AP) is the money your business owes to its vendors for providing goods or services to you on credit.

Startups do accounting by implementing a range of financial management techniques, depending on the founders financial sophistication and time. The best startups use a cloud-based accounting software like QuickBooks Online to do basic bookkeeping, which includes tracking income, expenses, and other financial transactions. They may DIY their books, but should work with a CPA firm to file taxes and ensure state and local tax compliance. VC-backed businesses typically choose to outsource their bookkeeping and tax preparation/compliance to experienced CPA firms. A bookkeeper typically focuses on accounting consulting processing and recording transactions, including things like invoices, receivables, payments, and other essential functions.

The most tech-forward

Startup accounting provides valuable insight into your startup’s cash flow and also allows you to make financial projections. Most importantly, it ensures that your startup is staying compliant. Many startups outsource their financial reporting and management functions, both to save money and to get professional accounting and https://x.com/bookstimeinc finance services that would be difficult to locate and hire. As the company grows, management eventually hires the appropriate personnel and brings these financial functions in-house.

Accenture Ventures

- Time to focus on building product, getting sales, hiring, fundraising – time is very percious to a startup, so outsource non-essential tasks like books as soon as it’s affordable.

- We also are tax experts – which may seem odd, as startups lose money, so why do they worry about taxes?

- Plus, they work closely with Deloitte’s pre-existing worldwide community of catalysts to find investors and others who can play a role in development.

- A general ledger is a compilation of entries detailing each of your business’s financial transactions.

- Additionally, Zoho’s accounting software offers a variety of tax features to ensure your business stays tax-compliant.

They provide end-to-end solutions to inform and incubate the startups that they work with. Services across the entrepreneurial life cycle help to speed up business growth. Plus, they work closely with Deloitte’s pre-existing worldwide community of catalysts to find investors and others who can play a role in development. Startup consulting is when specialized advisors are brought into a startup on a short term basis assets = liabilities + equity to help move a specific aspect of the company forward.

Explores solutions and opportunities

Your CPA won’t perform tests or examine any internal controls, but will do a cursory check of your company’s financial statements to ensure there aren’t any obvious issues. Bookkeeping, CFO, and tax services for startups and small businesses. Most accounting software for startups will automatically compare bank accounts with general ledger entries.

CPAs are legally allowed to provide tax services above and beyond what other accounting professionals can do. And this advice can be extremely valuable (in fact, our clients are saving tens of millions of dollars a year on taxes due to our accounting team’s tax work – and that’s for unprofitable startups who don’t ordinary owe income tax!). In the bustling landscape of New York, a city renowned for its vibrant startup scene and financial prowess, our accounting firm emerges as a pivotal ally for emerging businesses. Strategically located for those seeking an ‘accounting firm near me’ in New York, our services encompass a comprehensive range of offerings including bookkeeping, tax preparation, accounting, finance, and fractional CFO work.

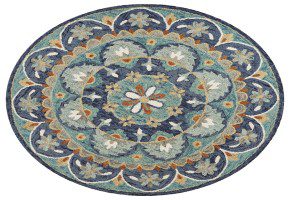

Round Rugs

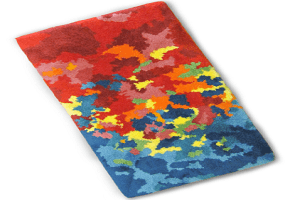

Round Rugs  Wool Rugs

Wool Rugs  Vintage Rugs

Vintage Rugs

Carpet Tiles

Carpet Tiles  Carpet

Carpet

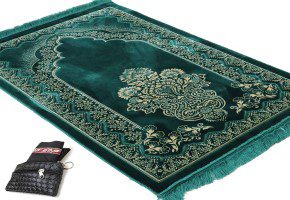

Embossed Rug

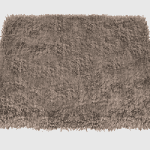

Embossed Rug  Plain Rug

Plain Rug

2.5'*4'

2.5'*4'  2'*3'

2'*3'  3'*5'

3'*5'  5*7.5

5*7.5

Artificial Grass

Artificial Grass  Mats

Mats

Soil

Soil  Fertilizer

Fertilizer  Pesticides

Pesticides