The earnings per share figure is especially meaningful when investors look at both historical and future EPS figures for the same company, or when they compare EPS for companies within the same industry. For example, they may compare the forward EPS (that uses projections) with the company’s actual EPS for the current quarter. If the actual EPS falls short of forward EPS projections, the stock price may fall as investors register their disappointment. Earnings per share (EPS) is an important metric that investors and analysts use to assess the profit a company generates per share of stock. The most commonly used version is the trailing twelve months (TTM) EPS, which can be calculated by adding up earnings per share for the past four quarters. This does mean that basic share count will change from period to period.

Basic Earnings Per Share (EPS): Definition, Formula, Example

Earnings per share (EPS) is of two types – (i) basic earnings per share (BEPS) and (ii) dilutive earnings per share (DEPS). Which type of EPS a company needs to report in its financial statements depends on its capital structure. The companies with simple capital structure report only basic EPS whereas those with complex capital structure are required to report both basic and dilutive EPS numbers.

Where Do I Find the Net Income Figure for the EPS Calculation?

One caveat, however, is that high-growth companies with minimal profits at the “bottom line” can still obtain high valuations from the market. All else being equal, the market tends to be willing to pay more for companies with higher net profits. Diluted EPS, on the other hand, reflects the potential dilution that could occur if convertible securities or options were exercised. If a firm is liquidated, the book value earnings per share are enough to calculate the worth of each share. This sort of earnings per share allows for consistent comparisons by excluding unusual occurrences like the sale of a major division, which would distort comparative figures.

Great! The Financial Professional Will Get Back To You Soon.

The earnings per share ratio will help that investor understand the capacity a company has for higher dividends in the future. It is a tool that is used frequently by investors, but is by no means the only measure of a company’s export xero to google sheets and other formats financial future. You should take into account all of the financial information available to make an investment decision. Earnings per share means the money you would earn for owning each share of common stock.

) Reported Earnings Per Share

Most P/E ratios are calculated using the trailing EPS because it represents what actually happened, and not what might be. On the other hand, while the figure is accurate, the trailing EPS is often considered old news. Companies may choose to buy back their own shares in the open market to improve EPS. The better EPS results from the net income being divided up by a fewer number of shares. And, historically speaking, EPS has been the standard measurement when comparing stocks and evaluating a company’s profitability. The price-to-earnings (P/E) ratio and EPS work together but evaluate different things.

There are five types of earnings per share, which are discussed further down. The following are the many sorts of earnings per share that differ from the calculation described above. However, if the company instead makes 20,000 USD to pay investors, each unit of the share will then be 200 USD.

- EPS stands for earnings per share, which is the amount of a company’s net earnings per share of outstanding stock.

- Earnings per share, or EPS, is a ratio that divides a company’s earnings by the number of shares outstanding to evaluate profitability and gain a pulse of the company’s financial health.

- Whether adjusted or unadjusted (also known as GAAP net profit, as its calculation confirms to Generally Accepted Accounting Principles), the “earnings” in “earnings per share” almost exclusively refers to net profit.

- Rolling EPS gives an annual earnings per share (EPS) estimate by combining EPS from the past two quarters with estimated EPS from the next two quarters.

- A more refined calculation adjusts the numerator and denominator for shares that could be created through options, convertible debt, or warrants.

A higher EPS generally indicates a higher value and profits relative to a company’s stock price, though there’s no number set as a “good” EPS. Instead, consider EPS trends over time and how a company’s EPS compares to that of its peers. As important as EPS is, it’s wise to look at other profitability metrics as well, such as operating income and free cash flow. Moreover, EPS only considers net income and overlooks the capital required to generate earnings, market price, and stock performance, thus ignoring several other factors. For example, buybacks can affect EPS, as the number of outstanding shares is then reduced.

It can be calculated using different methodologies, which is important to keep in mind when comparing companies across industries. Basic EPS is calculated by dividing a company’s net income by the number of its outstanding shares. Preferred shares are classified into cumulative preferred, non-cumulative, participating preferred, and convertible preferred stocks. Preferred shares, as the name implies, give preference to preferred shareholders and pay them dividends before common ones.

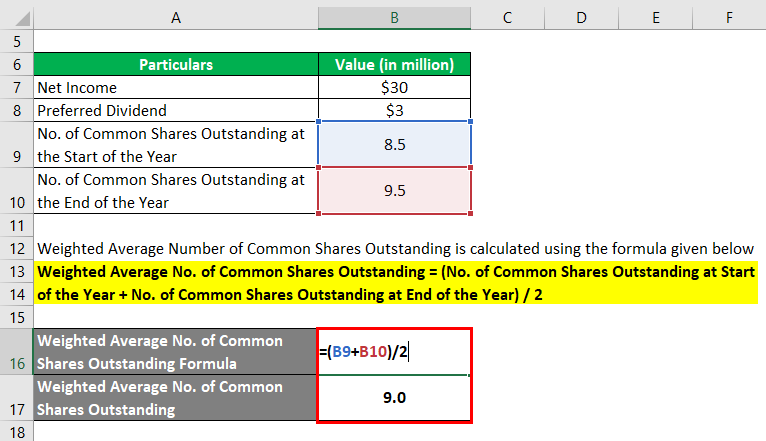

The formula in the table above calculates the basic EPS of each of these select companies. Basic EPS does not factor in the dilutive effect of shares that could be issued by the company. Earnings per share (EPS) is a measure of a company’s profitability that indicates how much profit each outstanding share of common stock has earned. It’s calculated by dividing the company’s net income by the total number of outstanding shares.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Ask a question about your financial situation providing as much detail as possible. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

In other words, somebody who owns one or more common shares is part-owner of the corporation which issued those shares. Comparing EPS in absolute terms may not have much meaning to investors because ordinary shareholders do not have direct access to the earnings. Instead, investors will compare EPS with the share price of the stock to determine the value of earnings and how investors feel about future growth. Any stock dividends or splits that occur must be reflected in the calculation of the weighted average number of shares outstanding. Some data sources simplify the calculation by using the number of shares outstanding at the end of a period.

Round Rugs

Round Rugs  Wool Rugs

Wool Rugs  Vintage Rugs

Vintage Rugs

Carpet Tiles

Carpet Tiles  Carpet

Carpet

Embossed Rug

Embossed Rug  Plain Rug

Plain Rug

2.5'*4'

2.5'*4'  2'*3'

2'*3'  3'*5'

3'*5'  5*7.5

5*7.5

Artificial Grass

Artificial Grass  Mats

Mats

Soil

Soil  Fertilizer

Fertilizer  Pesticides

Pesticides