How Robotic Process Automation is Revolutionizing the Banking Sector

Data retrieval from bills, certificates, and invoices can be automated as well as data entry into payment processing systems for importers so that payment operations are streamlined and manual processes reduced. In 2020, most consumers and banking institutions are generally familiar with artificial intelligence driving intelligent automation in banking. Today, many organizations are taking the conversations to the next level and deploying AI-based technologies company wide.

How IT Automation Leads to a New Level of Operational Efficiency … – International Banker

How IT Automation Leads to a New Level of Operational Efficiency ….

Posted: Wed, 15 Feb 2023 08:00:00 GMT [source]

Not to mention, many banks struggle to determine which technologies should be prioritized to get the most out of their investments and which ones can align best with their business objectives. Relying on manual processes instead of financial process automation is blocking banks’ ability to generate income while at the same time exposing banks to unnecessary risks caused by human error. This problem can be solved if banks establish user-driven data control and automation.

Accounts payable

As a result of RPA, financial institutions and accounting departments can automate formerly manual operations, freeing workers’ time to concentrate on higher-value work and giving their companies a competitive edge. The applications of banking automation span from optimizing daily operations to completely reshaping customer experiences and product offerings. This technology empowers financial institutions to maintain their competitive edge, improve services, and adapt to the evolving demands of the modern financial landscape.

- Sweden’s SEB bank is one of a handful of large banks and insurers (including UBS and insurer VGZ) that have enlisted the help of chatbots or cognitive agents to deal with customers.

- Postbank, one of the leading banks in Bulgaria, has adopted RPA to streamline 20 loan administration processes.

- Over the last few years, banks have made foundational investments in data lakes, process excellence and customer journeys.

- In addition to helping employees generate reports, RPA in banking can also assist compliance officers in processing suspicious activity reports (SAR).

- This can be a significant challenge for banks to comply with all the regulations.

Workflow software compliments RPA technology by making up for where it falls short – full process automation. For example, a customer interaction with a chatbot can trigger a support ticket or application process in workflow software without the customer entering a brick-and-mortar location or tying up staff. This way, human resources can be reapplied to tasks that are more integral to the company. The right workflow software can mean the difference between a financial services company that is efficient and customer-oriented and one that with outdated processes that will eventually put it at a competitive disadvantage. Adoption of robotic process automation (RPA) is one clear way that banks and other financial institutions can increase efficiency and boost productivity, while also reducing errors and costs. In fact, a recent report [from KPMG] has revealed that RPA can reduce costs for financial services organizations by up to 75%.

Game-Changing Processes Leading Banks Has Automated

Banks, lenders, and other financial institutions may collaborate with different industries to expand the scope of their products and services. RPA utilizes structured data to complete tasks it helps in performing redundant tasks quickly without error. Examples of tasks where RPA technology works well are data entry, data processing and mapping, and client onboarding and new account openings. Banking is an extremely competitive industry, which is facing unprecedented challenges in staying profitable and successful.

Banks can automate their processes with the use of technology to boost productivity without complicating procedures that require compliance. Banking Automation is the process of using technology to do things for you so that you don’t have to. Because of the multiple benefits it provides, automation has become a valuable tool in almost all businesses, and the banking industry cannot afford to operate without it. Know your customer processes are rule-based and occupy a lot of FTE’s time. With multiple documents to check, scan, and validate, KYC is an error-prone and manual process for most of banks. As a result, financial institutions must foster an innovation culture in which technology is used to improve existing processes and procedures for optimal efficiency.

Robust Security Measures for Data

Let’s observe some areas where automation has significantly impacted and improved ROI for the financial services sector. This article covers 10 use cases of automation in financial services, its benefits, and quick tips on implementation. Our experience in the banking industry makes it easy for us to ensure compliance and build competitive solutions using cutting-edge technology.

With RPA and automation, faster trade processing – paired with higher bookings accuracy – allows analysts to devote more attention to clients and markets. Discover smarter self-service customer journeys, and equip contact center agents with data that dramatically lowers average handling times. With UiPath, SMTB built over 500 workflow automations to streamline operations across the enterprise.

What Is Banking Automation?

Many industries are transitioning towards the adoption of automation in end-to-end processes. Financial service institutions are making an effort to take advantage of this potential because work can be done more quickly, more cheaply, and efficiently. However, the scenarios are more likely to be a combination of man-machine models instead of just one eliminating the other. Intelligent automation in banking can be used to retrieve names and titles to feed into screening systems that can identify false positives. With the never-ending list of requirements to meet regulatory and compliance mandates, intelligent automation can enhance the operational effort.

Offer customers an excellent digital loan application experience, eliminate manual data entry, minimize reliance on IT, and ensure top-notch security. Financial enterprises can use intelligent automation to automate the account opening process, reducing the time and effort required to onboard customers. This process could include automating data collection, document verification, and KYC (Know Your Customer) checks. Automated underwriting saves manual underwriting labor costs and boosts loan providers’ profit margins and client satisfaction.

Do but Don’t Rush – A Practical Guide to Automation in Banking

Insights are discovered through consumer encounters and constant organizational analysis, and insights lead to innovation. However, insights without action are useless; financial institutions must be ready to pivot as needed to meet market demands while also improving the client experience. Keeping daily records of business transactions and profit and loss allows you to plan ahead of time and detect problems early. You can avoid losses by being proactive in controlling and dealing with these challenges.

This is because it eliminates the boring, repetitive, and time-consuming procedures connected with the banking process, such as paperwork. An automated business strategy would help in a mid-to-large banking business setting by streamlining operations, which would boost employee productivity. For example, having one ATM machine could simplify withdrawals and deposits by ten bank workers at the counter.

Customer onboarding, especially due to KYC guidelines, can be a time-consuming process in that the user’s identity needs to be verified through substantial document reviews. As with report generation, RPA can also be used to support and strengthen regulatory compliance efforts. The system can also flag potential instances of non-compliance, which can then be reviewed and resolved manually by a compliance officer. In this post, we explore how Robotic Process Automation is being deployed within the financial services industry and how this technology helps with banking. As we contemplate what automation means for banking in the future, can we draw any lessons from one of the most successful innovations the industry has seen—the automated teller machine, or ATM? Of course, the ATM as we know it now may be a far cry from the supermachines of tomorrow, but it might be instructive to understand how the ATM transformed branch banking operations and the jobs of tellers.

Operations that are often performed manually by bank employees include customer onboarding to collect essential data on customers and execute regulatory, legal, and credit-related due diligence with identity checks. Combining, transforming, enriching, and reconciling data is also often done manually. Chatbots reduce wait time in long queues, one of the cornerstones of an excellent modern customer experience. They also reduce time spent transferring from one department to another because they can collect enough data from their automated interaction to transfer the client directly to the person best equipped to solve their problem. Customers also value the ability to interact on their preferred platform, be that a phone call, SMS, email, or social media. Chatbots can save these preferences and perform banking interactions with customers right where they are most comfortable.

Once you’ve successfully implemented a new automation service, it’s essential to evaluate the entire implementation. Decide what worked well, which ideas didn’t perform as well as you hoped, and look for ways to improve future banking automation implementation strategies. Lenders rely on banking automation to increase efficiency throughout the process, including loan origination and task assignment.

Read more about https://www.metadialog.com/ here.

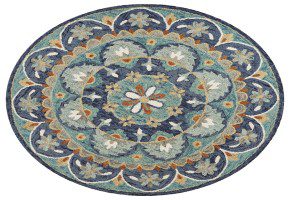

Round Rugs

Round Rugs  Wool Rugs

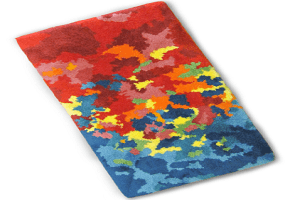

Wool Rugs  Vintage Rugs

Vintage Rugs

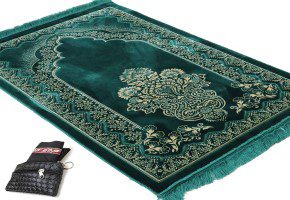

Carpet Tiles

Carpet Tiles  Carpet

Carpet

Embossed Rug

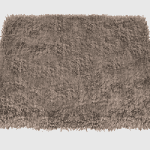

Embossed Rug  Plain Rug

Plain Rug

2.5'*4'

2.5'*4'  2'*3'

2'*3'  3'*5'

3'*5'  5*7.5

5*7.5

Artificial Grass

Artificial Grass  Mats

Mats

Soil

Soil  Fertilizer

Fertilizer  Pesticides

Pesticides