Intelligent Automation in Financial Services & Banking in 2023

These campaigns not only enable banks to optimize the customer experience based on direct feedback but also enables customers a voice in this important process. With threats to financial institutions on the rise, traditional banks must continue to reinforce their cybersecurity and identity protection as a survival imperative. Risk detection and analysis require a high level of computing capacity — a level of capacity found only in cloud computing technology. Cloud computing also offers a higher degree of scalability, which makes it more cost-effective for banks to scrutinize transactions.

Process automation has revolutionized claims management and customer support in the financial sector. Inquiries and issues are resolved more quickly, increasing customer satisfaction and a strong reputation for the institution. BPM stands out for its ability to adapt to the changing needs of the financial business. From small businesses to large corporations, BPM technology is highly scalable and can grow with the institution. This flexibility ensures that automation is not just a short-term solution, but a long-term investment that lasts over time. Instead of waiting for mistakes and their possible consequences to happen, your organization can drastically reduce the number of errors, imbalances, and more by automating the balance sheet reconciliation process.

Automation in Banking

From day one we, at Nividous, have focused on building a unified intelligent automation platform that harnesses power of RPA, AI and BPM. These three key pillars of holistic automation are natively available within the platform. With continuous innovation in our products and services, we endeavor to help our customers improve their competitive advantages. Chatbots and virtual assistants have become indispensable in enhancing customer service and support. These AI-driven banking automation products engage with customers in real-time, answering inquiries, providing account information, and assisting with transactions.

The banks require paper-based processes for compliance and audits; however, paper, system siloes, and fluctuating workloads put a heavy drag on the overall process turnaround time. They have different options available in the market for their banking requirements and may result in customer churn for faster and diligent banking services. Banking and Automation- the two terms are synonymous to each other in the same way bread is to butter – always clubbed together. We live in a digital age and hence, no institution of the global economy can be immune from automation and the advent of digital means of operations. In fact, banks and financial institutions were among the first adopters of automation considering the humongous benefits that they get from embracing IT.

Banking software development

One of the largest banks in the United States, KeyBank’s customer base spans retail, small business, corporate, commercial, and investment clients. Another AI-driven solution, Virtual Assistant in banking, is also gaining traction. Federal Reserve Board of Governors’ says banks still have “work to do” to meet supervision and regulation expectations. AML, Data Security, Consumer Protection, and so on, regulations are emerging parallel to technological innovations and developments in the banking industry. This can be a significant challenge for banks to comply with all the regulations.

- He advised enterprises on their technology decisions at McKinsey & Company and Altman Solon for more than a decade.

- Automation in banking serves as a catalyst for delivering an exceptional customer experience.

- But given the high volume of complex data in banking, you’ll need ML systems for fraud detection.

- The cognitive technologies have unfolded immense potential for this industry, helping them meet the dynamic customer demands while improving the business ROI.

Any files uploaded through the application can be safely stored in your storage provider of choice. For those accepted, create personalized terms documentation featuring their credit limit, card choice, and APR. Even customers who enjoy in-person banking expect a truly omnichannel banking experience, where they can seamlessly switch between physical and digital channels. Exponential Digital Solutions (10xDS) is a new age organization where traditional consulting converges with digital technologies and innovative solutions.

Stakeholders have appreciated how our low-code platform enables rapid creation & deployment of automated customer journeys that can cut administrative costs and elevate your banking experience. These bots are developed through a blend of machine learning and artificial intelligence, a process that involves AI and ML development alongside software programming. Software Bots in RPA are designed to mimic human actions, interacting with various digital systems, applications, and data sources.

He advised enterprises on their technology decisions at McKinsey & Company and Altman Solon for more than a decade. He led technology strategy and procurement of a telco while reporting to the CEO. He has also led commercial growth of deep tech company Hypatos that reached a 7 digit annual recurring revenue and a 9 digit valuation from 0 within 2 years. Cem’s work in Hypatos was covered by leading technology publications like TechCrunch and Business Insider. He graduated from Bogazici University as a computer engineer and holds an MBA from Columbia Business School.

Yet banking automation is also a powerful way to redefine a bank’s relationship with customers and employees, even if most don’t currently think of it this way. Our software platform streamlines the process of data integration, analytics and reporting by cleaning and joining the sourced data through semantics and machine learning algorithms. It simplifies data governance process and generates timely and accurate reports to be submitted to regulators in the correct formats.

Read more about https://www.metadialog.com/ here.

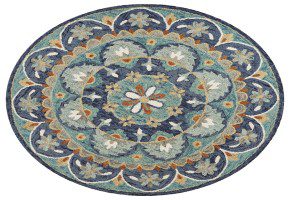

Round Rugs

Round Rugs  Wool Rugs

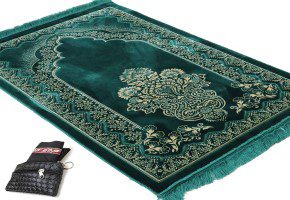

Wool Rugs  Vintage Rugs

Vintage Rugs

Carpet Tiles

Carpet Tiles  Carpet

Carpet

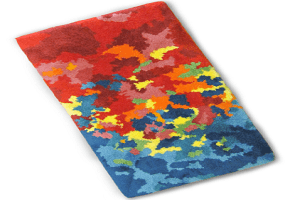

Embossed Rug

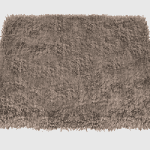

Embossed Rug  Plain Rug

Plain Rug

2.5'*4'

2.5'*4'  2'*3'

2'*3'  3'*5'

3'*5'  5*7.5

5*7.5

Artificial Grass

Artificial Grass  Mats

Mats

Soil

Soil  Fertilizer

Fertilizer  Pesticides

Pesticides