That’s why an estimate from an online calculator will likely differ somewhat from the result of the present value formula discussed earlier. We’ll calculate the yield to maturity (YTM) using the “RATE” Excel function in the final step. In our illustrative example, we’ll calculate an annuity’s present value (PV) under two different scenarios. The trade-off with fixed annuities is that an owner could miss out on any changes in market conditions that could have been favorable in terms of returns, but fixed annuities do offer more predictability.

How We Make Money

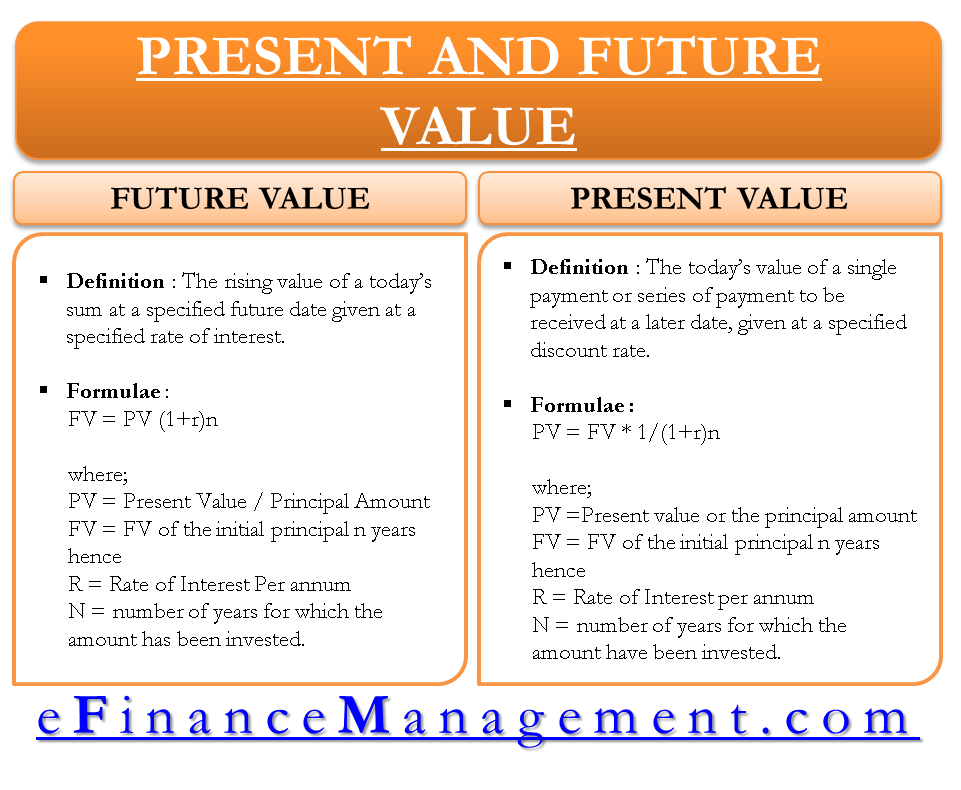

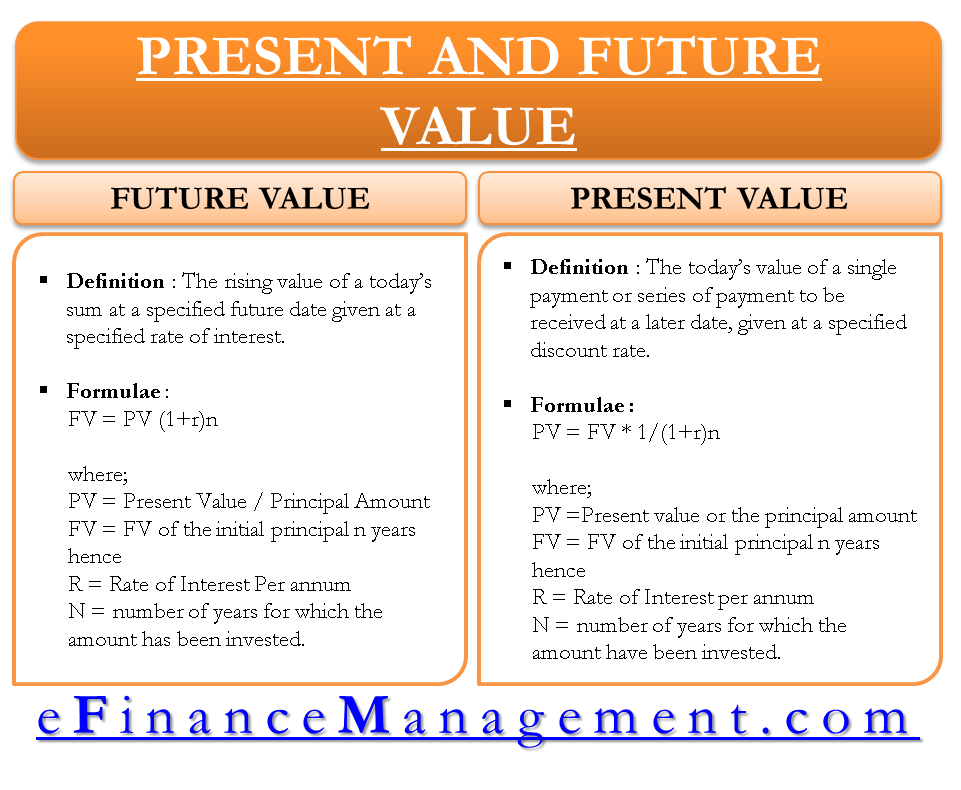

It’s important to note that the discount rate used in the present value calculation is not the same as the interest rate that may be applied to the payments in the annuity. The discount rate reflects the time value of money, while the interest rate applied to the annuity payments reflects the cost of borrowing or the return earned on the investment. The discount rate is a key factor in calculating the present value of an annuity.

Do you already work with a financial advisor?

- Note that the annuity stops one payment short of the end of the loan contract, so you need to use \(N − 1\) rather than \(N\).

- Although this approach may seem straightforward, the calculation may become burdensome if the annuity involves an extended interval.

- This may be found by discounting each cash flow back at a given rate.

Content includes articles, marketing materials, agent information used as content on all pages. Content used by Annuity.com as information for the public, enhancement of any agents reputation and lead generation for all sources is copyrighted. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

Related Retirement Calculators:

If you would like to learn more about annuities, check our time value of money calculator or the annuity payout calculator. The figure shows the present value and interest amounts in the transaction. In return, it receives 35 payments of $1,282.20 and one payment of $1,282.49 for a nominal total of $46,159.49. The figure shows how much principal and interest make up the payments. To have his retirement income increased by $10,000 after six years, Rodriguez needs to have $585,742.42 invested in his retirement fund at age 65. Speak with one of our qualified financial professionals today to find out how an annuity can offer you guaranteed monthly income for life.

The factor is determined by the interest rate (r in the formula) and the number of periods in which payments will be made (n in the formula). In an annuity table, the number of periods is commonly depicted down the left column. Simply select the correct interest rate and number of periods to find your factor in the intersecting cell. That factor is then multiplied by the dollar amount of the annuity payment to arrive at the present value of the ordinary annuity. For example, a court settlement might entitle the recipient to $2,000 per month for 30 years, but the receiving party may be uncomfortable getting paid over time and request a cash settlement. The equivalent value would then be determined by using the present value of annuity formula.

Many companies buy annuities so annuity holders can get cash now instead of payments later. These companies will calculate the present value and they may charge fees on top of that. So, is it worth it to take a lump sum of $81,000 today instead of $100,000 in payments over time? It could be if you invest it in higher-yield options and can get a good interest rate.

Immediate annuities start paying out right away, while deferred annuities have a delay before payments begin. The steps required to solve the future value of an annuity due are identical to those you use for an ordinary annuity except you use the formula for the future value of an annuity due. Suppose you can get a loan wherein you lottery tax calculator pay $12,000 a year for 5 years (including interest and repayments). You can use the table below to calculate Present Value for single cash flows. These tables are easily “googlable”, but we’ve provided our own versions below. The first one here relates is a Present Value Discount Factor Table for single cash flows (NOT annuities).

Future value (FV) is the value of a current asset at a future date based on an assumed rate of growth. It is important to investors as they can use it to estimate how much an investment made today will be worth in the future. This would aid them in making sound investment decisions based on their anticipated needs. However, external economic factors, such as inflation, can adversely affect the future value of the asset by eroding its value. The FV of money is also calculated using a discount rate, but extends into the future. The time value of money buttons are located in the [latex]TVM[/latex] row (the third row from the top) of the calculator.

They’ll walk you through all your options, simplify all the fancy financial jargon, and make sure you’re set up with the right financial protection for your retirement. In this section, you will calculate loan balances at any given point in time throughout the loan’s term. Use this calculator to find the present value of annuities due, ordinary regular annuities, growing annuities and perpetuities.

Assuming that the term is 5 years and the interest rate is 7%, the present value of the annuity is $315,927.28. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. Mortgages and certain notes payable in equal installments are examples of present-value-of-annuity problems. It is important to distinguish between the future value and the present value of an annuity.

The pension provider will determine the commuted value of the payment due to the beneficiary. They do this to ensure they are able to meet future payment obligations. If the winner was to invest all of his lottery prize money, he would have [latex]\$2,544,543.22[/latex] after [latex]25[/latex] years. After all of the known quantities are loaded into the calculator, press [latex]CPT[/latex] and then [latex]FV[/latex] to solve for the future value.

Round Rugs

Round Rugs  Wool Rugs

Wool Rugs  Vintage Rugs

Vintage Rugs

Carpet Tiles

Carpet Tiles  Carpet

Carpet

Embossed Rug

Embossed Rug  Plain Rug

Plain Rug

2.5'*4'

2.5'*4'  2'*3'

2'*3'  3'*5'

3'*5'  5*7.5

5*7.5

Artificial Grass

Artificial Grass  Mats

Mats

Soil

Soil  Fertilizer

Fertilizer  Pesticides

Pesticides